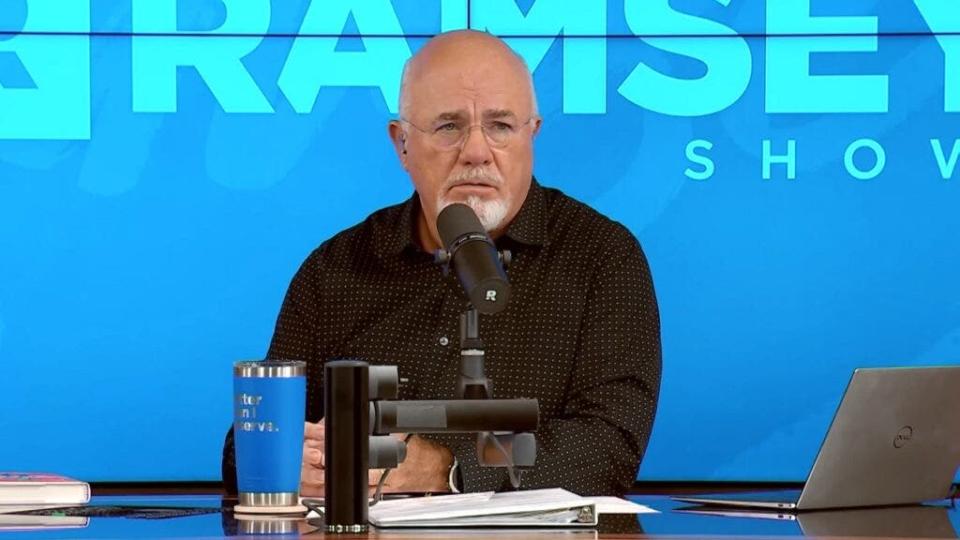

Financial expert Dave Ramsey has a clear message for anyone trying to figure out why they’re not making progress with their money: You could be wasting $5,000 a year on things you don’t need. In a recent tweet, Ramsey pointed out that spending just $13.70 a day on unnecessary purchases adds up to that much in a year.

Don’t miss:

It might not seem like much at first glance – after all, what is $13.70 a day? Maybe it’s a coffee, a packed lunch, or something you picked up online without a second thought. Ramsey’s point is that those small, day-to-day expenses can drain your bank account over time, preventing you from reaching bigger financial goals.

The impact of small expenses

How to waste $5,000 a year:

Spend $13.70 a day on things you don’t need.— Dave Ramsey (@DaveRamsey) September 3, 2024

Ramsey’s tweet puts into perspective how easy it is to lose track of your spending when you’re making small amounts. Many people don’t realize how quickly those “small” purchases can add up. $13.70 a day may not sound like much, but multiply that by 365 days and you’ve spent $5,000 on things you probably didn’t need.

Trends: Teens never need wisdom teeth removed thanks to this MedTech company – Be an early investor for only $300 for 100 shares!

For someone struggling to save for an emergency fund, pay off debt, or build long-term wealth, that $5,000 could make a big difference. Many people think they don’t spend much every day, but once they take a closer look, they realize how many small purchases are eating into their finances.

Simple changes, big results

Ramsey offers straightforward advice for cutting unnecessary spending: Be intentional. Make sure the money goes toward something worthwhile, like paying off debt, saving for a down payment on a house, or setting up an emergency fund. Create a budget, track expenses and monitor it.

See also: Number of “401(k)” millionaires up 43% over last year – Here are three ways to join the club.

What could you do with $5,000?

Think what an extra $5,000 a year could do for you. Maybe it’s the difference between living paycheck to paycheck and having a cushion of savings. It could help pay off high-interest debt, contribute to retirement, or allow you to take a vacation without going into credit card debt.

Ramsey often states that “your number one tool for building wealth is your income,” emphasizing that true financial success comes from prudent saving and investing, not debt to lenders like Sallie Mae or Best Buy.

Trends: A billion dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Ramsey examines how commonplace it has become to rely on debt to finance desires and investments, noting that “when you give someone else your income, you no longer have it.”

He challenges the idea that debt is normal, specifically evoking the flawed thinking behind student loans and credit card rewards. He humorously says, “Oh, Sallie Mae’s been with us for 15 freaking years in our spare bedroom,” highlighting how much student debt can weigh on people.

Read on:

UNLOCKED: 5 NEW TRANSLATIONS PER WEEK. Click now to get top trading ideas dailyplus unlimited access to state-of-the-art tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Dave Ramsey says you’re wasting $5,000 a year if you “spend $13.70 a day on things you don’t need” originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

#Dave #Ramsey #youre #wasting #year #spend #day #dont